▶Market Monitors

▶Reviews

▶Case Studies

Lisbon 5-Star Hotel Market: Across the Seven Hills

by Hotel Insider • 21 Sep 2025 • Download as PDF

Location: Portugal, Lisbon

|

Lisbon’s 5-star hotel market thrives on its blend of historic charm and international appeal. From the cobbled streets of Alfama to the upscale avenues of Avenida da Liberdade, Lisbon combines tradition with modern luxury, establishing itself as a leading city destination in Europe. In this Market Monitor, we explore the defining factors shaping Lisbon's luxury hotel market, with a focus on seven key areas:

|

By analyzing these key aspects, we uncover how Lisbon is shaping its position as a premier luxury destination—showing when hotels perform best, what drives their competitive edge, and where the strongest value is generated in the city’s 5-star segment.

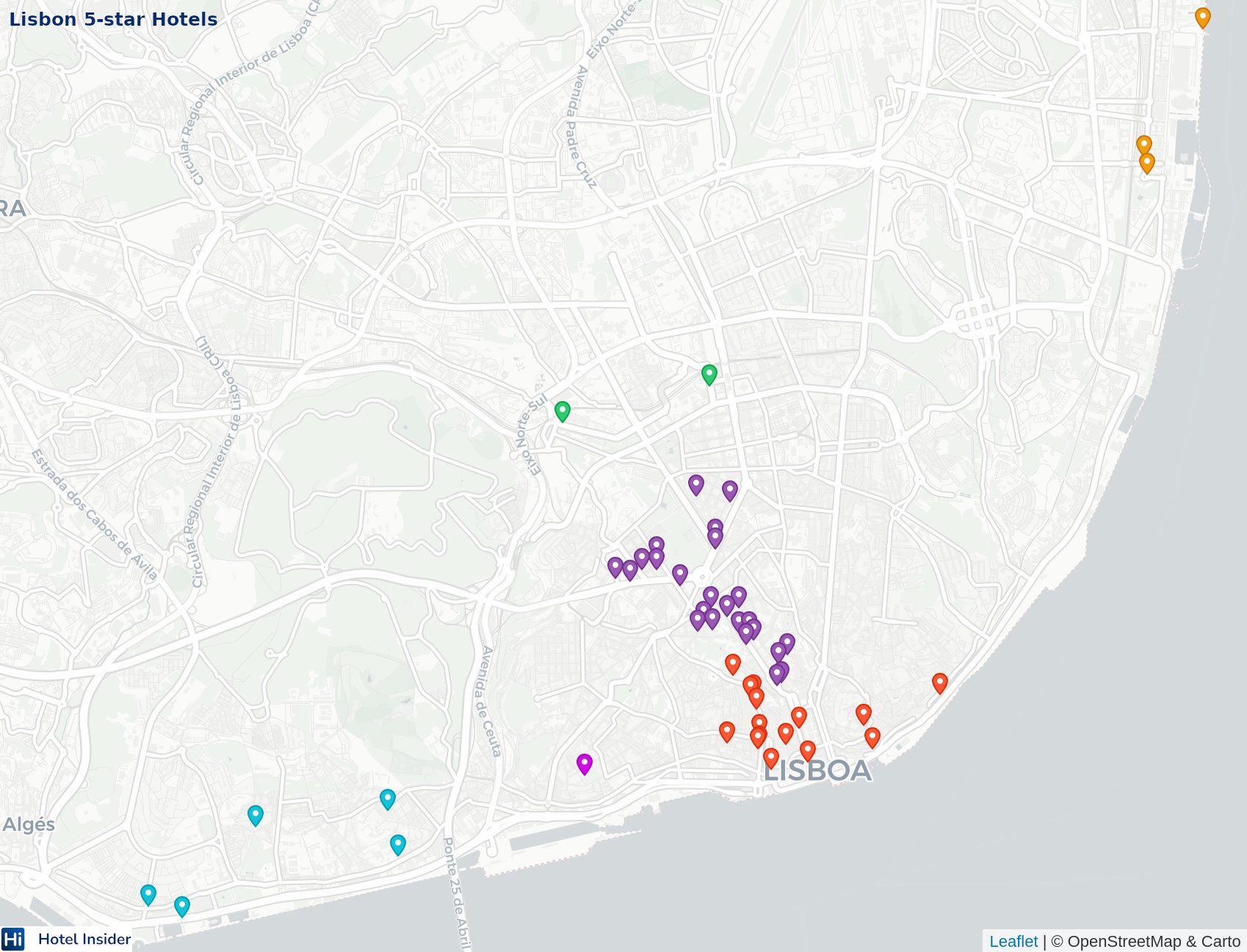

Where Are the 5-Star Hotels in Lisbon?

This map shows how 5-star hotels are spread across Lisbon—a compact yet diverse capital, blending historic neighborhoods, riverfront views, and cosmopolitan districts. Each area has its own character, attracting distinct segments of high-end travelers.

● Avenida da Liberdade / Marquês – Lisbon’s luxury boulevard. International brands, flagship hotels, and designer boutiques line this grand avenue, appealing to travelers who value prestige and shopping.

● Baixa / Chiado / Alfama / Mouraria – The historic core. Boutique hotels in heritage buildings, close to landmarks, cafés, and nightlife, offering an immersive experience in Lisbon’s old town.

● Amoreiras / Avenidas Novas – The business-residential heart. Modern towers and upscale hotels serve executives and leisure travelers seeking central access with comfort and scale.

● Príncipe Real / Estrela / Lapa – Leafy, refined districts with gardens and historic palaces. Hotels emphasize exclusivity, boutique style, and quiet sophistication.

● Belém / Alcântara – Riverside west, rich in museums and monuments. Luxury properties here focus on wellness, heritage, and proximity to Lisbon’s cultural landmarks.

● Parque das Nações – Lisbon’s modern riverside east. Futuristic architecture and contemporary hotels cater to business travelers, families, and event-goers.

From grand boulevards to riverside escapes and hilltop retreats, Lisbon offers a diverse mix of 5-star stays—balancing tradition, modernity, and luxury in every district.

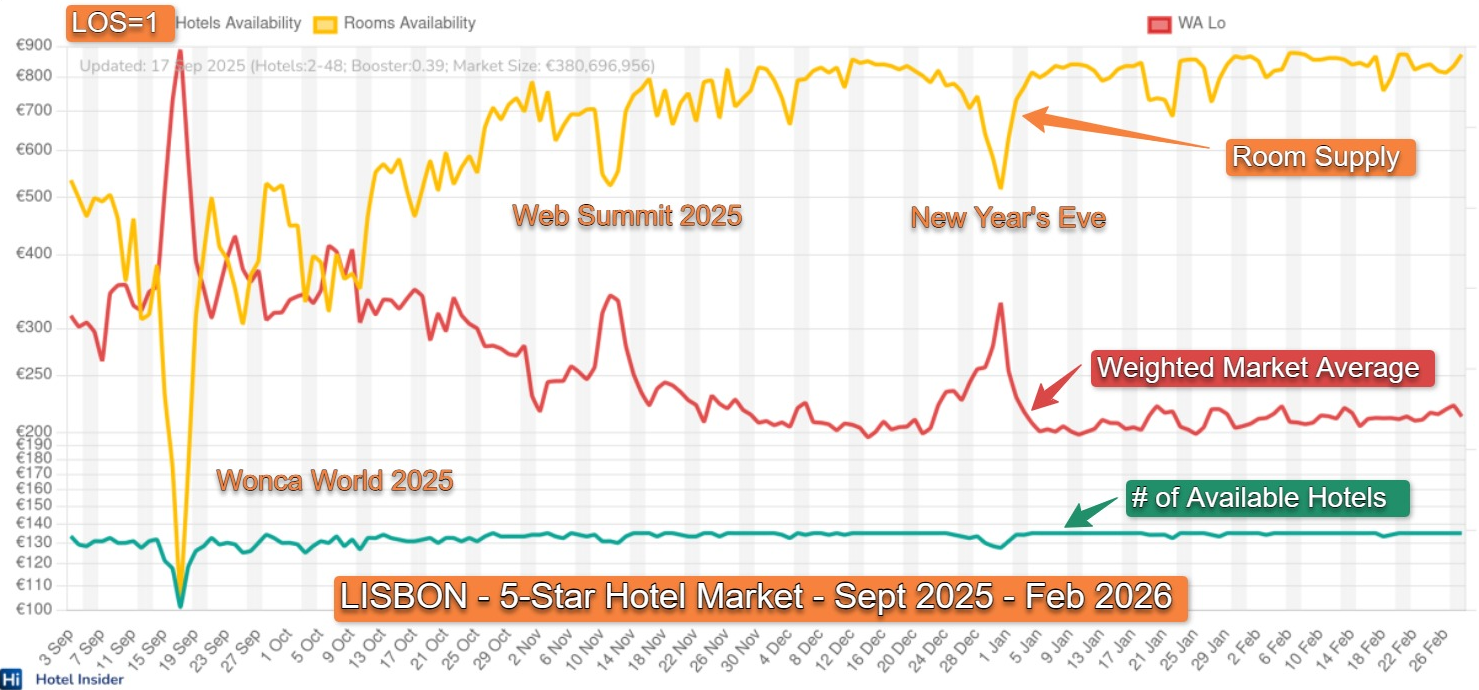

Rates For Sept 2025 – Feb 2026

Here’s a look at how the Lisbon 5-star hotel market performs for 1-night stays, which offer the strongest resolution in order to observe the market patterns for this urban, business- and leisure-mix destination.

Unlike classic leisure markets, there is no clear weekend/weekday pattern. Pricing and availability are largely flat across the week, reflecting Lisbon’s steady mix of business travelers, city-break tourists, and event-driven demand.

The market shows strong reaction to citywide events. Prices spike during Wonca World 2025 in September, during Web Summit 2025 in early November, and again around New Year’s Eve. These periods see both elevated rates and slight dips in available room supply, indicating compression.

Between mid-November and mid-December and again from early January through February, rates are at their lowest, with stable and abundant supply—clearly the low season for this segment.

💡 How to use it:

Lisbon hoteliers should anchor revenue strategy to the city’s event calendar available in Hotel Insider. Compression dates offer clear yield opportunities, while low-season periods present a case for targeted promotions or packaging to stimulate demand. Since weekday/weekend pricing differences are minimal, focus should remain on event-based segmentation rather than traditional business vs. leisure splits.

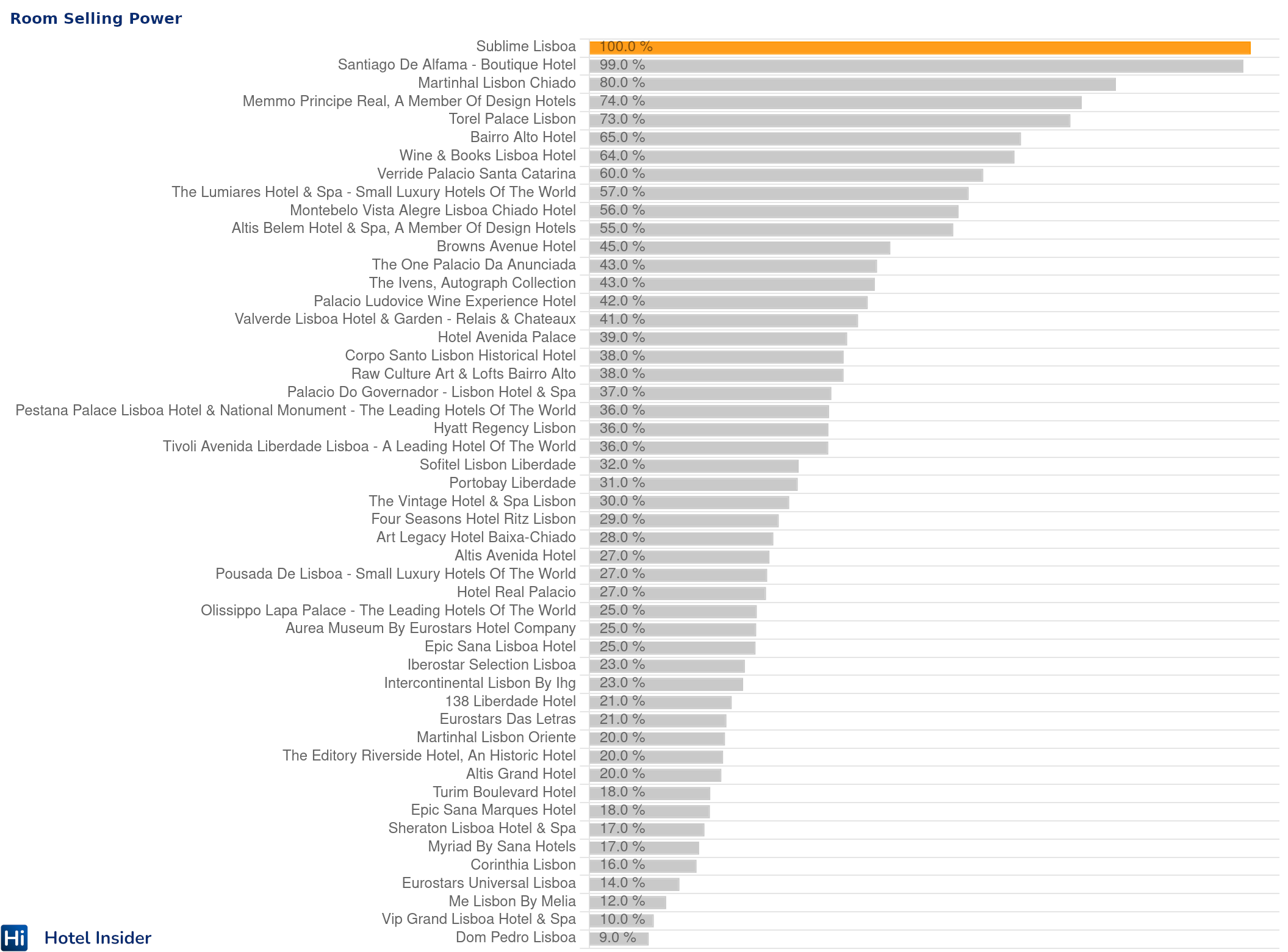

Room Selling Power

Lisbon’s 5-star hotels do not all perform equally when it comes to filling their rooms. Some properties stand out by converting attention and visibility into real bookings with remarkable efficiency. This “Room Selling Power” score combines brand strength, reputation, reviews, value for money, and the size of inventory. The leaders below show which hotels dominate Lisbon’s competitive luxury segment and are often the first to sell out in peak periods.

🏆 Here are the Top 15 Lisbon 5-star hotels with the highest room-selling power:

- Sublime Lisboa (100.0%) – Boutique sophistication with modern design, setting the benchmark for Lisbon luxury stays.

- Santiago De Alfama – Boutique Hotel (99.0%) – Intimate historic charm in Alfama, blending heritage and personalized service.

- Martinhal Lisbon Chiado (80.0%) – Family-focused luxury in the city center, seamlessly combining comfort and elegance.

- Memmo Príncipe Real, A Member Of Design Hotels (74.0%) – Contemporary design and panoramic city views make it a design-lover’s destination.

- Torel Palace Lisbon (73.0%) – A historic palace reimagined as an elegant retreat with character and style.

- Bairro Alto Hotel (65.0%) – Iconic and centrally located, known for its rooftop views and sophisticated atmosphere.

- Wine & Books Lisboa Hotel (64.0%) – A literary-inspired concept hotel with a refined and creative twist.

- Verride Palácio Santa Catarina (60.0%) – A restored palace offering royal grandeur paired with modern indulgence.

- The Lumiares Hotel & Spa – Small Luxury Hotels Of The World (57.0%) – Apartment-style suites with luxury touches, ideal for longer stays.

- Montebelo Vista Alegre Lisboa Chiado Hotel (56.0%) – Stylishly tied to Portuguese porcelain heritage, offering unique design value.

- Altis Belém Hotel & Spa, A Member Of Design Hotels (55.0%) – Sleek riverside escape with modern architecture and a celebrated spa.

- Browns Avenue Hotel (45.0%) – Trendy and vibrant, appealing to younger luxury travelers seeking a fresh vibe.

- The One Palácio da Anunciada (43.0%) – A grand 16th-century palace turned into a refined urban sanctuary.

- The Ivens, Autograph Collection (43.0%) – Explorer-themed luxury with a bold, adventurous design identity.

- Palácio Ludovice Wine Experience Hotel (42.0%) – Wine-focused elegance with immersive enology experiences in a noble palace.

Lisbon’s luxury market is led by boutique and design-focused properties that know how to stand out. For travelers, these hotels are high-demand and should be booked early. For competitors, they set the benchmarks in visibility, positioning, and guest experience that define success in Lisbon’s 5-star segment.

💡 How to use it:

Your spot in this ranking shows how well you turn interest into bookings. Selling out too quickly may mean underpricing. Slow pickup despite heavy marketing suggests weak selling power. By tracking your position over time, you can decide whether to adjust rates, strengthen visibility, or refine your value proposition to capture more demand.

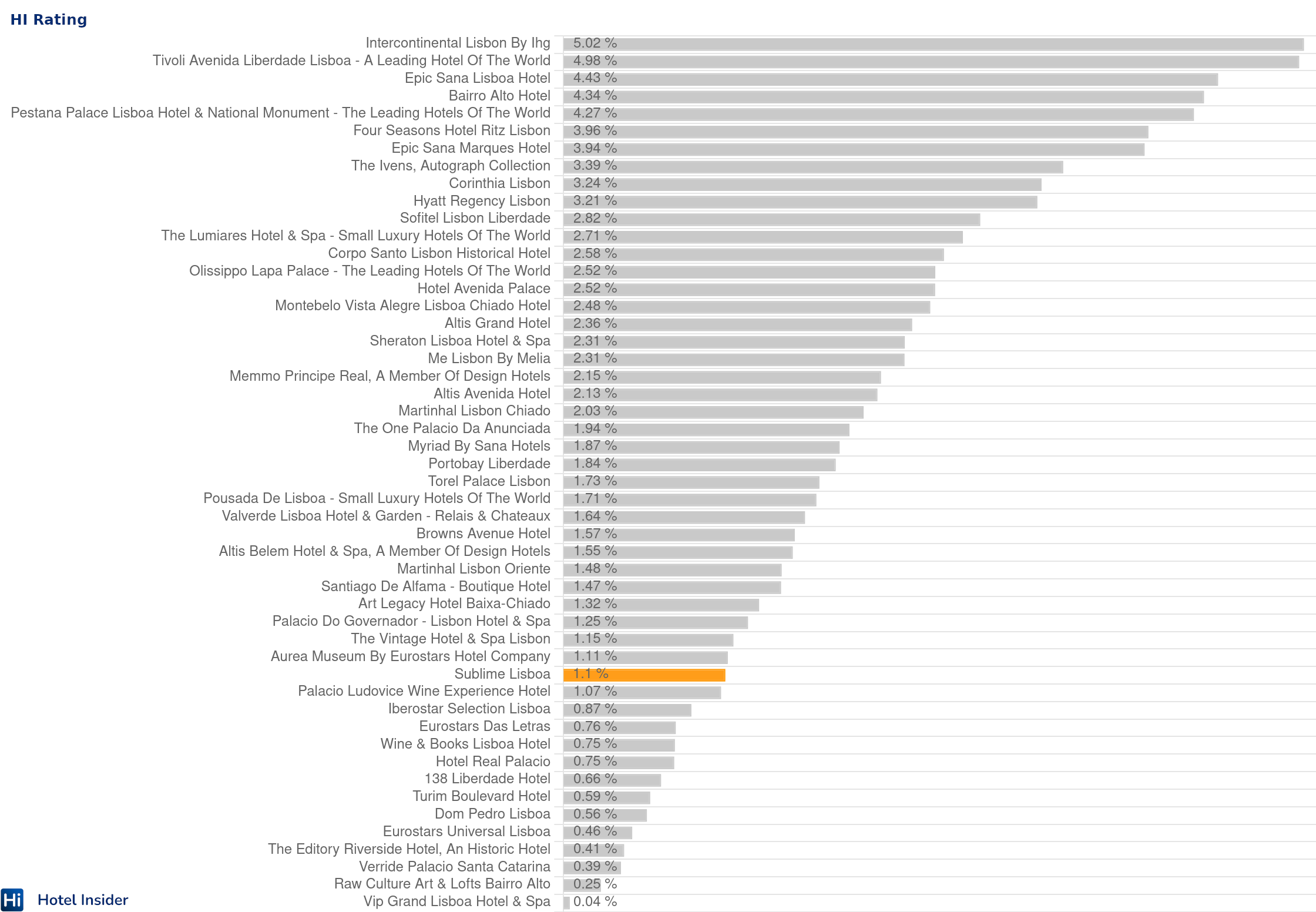

HI Rating – Market Influence

Alongside our RSP index (which measures efficiency in room sales), we use the HI Rating to measure each hotel's relative influence on the market rate. This is calculated by combining the measured public interest and individual merits of a property, regardless of size.

Key Observations

-

Market Leaders by Influence

Intercontinental Lisbon leads (≈ 5.02 %), followed by Tivoli Avenida Liberdade (4.98 %) and Epic Sana Lisboa (4.43 %). These are the properties whose rate changes will move the weighted average market rate most. -

High Quality Beats Size

Because room count is excluded, smaller boutique hotels with excellent guest ratings can score high influence. Bairro Alto Hotel ranks high here (4th) and also high on RSP list (6th), illustrating both strong guest perception and pricing power. -

Efficiency vs. Market Significance

Sublime Lisboa leads on RSP (fast seller), but carries only ~1.1 % weight in the HI Rating. It shows selling speed is different from price influence in the market.

SP500 Analogy:

Think of HI Rating like the weight of a company in the S&P 500 index. For example, Apple currently makes up ~5-6 % of the S&P 500 by market capitalization. Just as Apple’s performance heavily influences the S&P’s movement, properties with high HI Ratings pull the market’s average rate when they change their pricing.

💡 How to Use This:

In Hotel Insider, we calculate the market’s weighted average daily rate using the HI Rating as weights. This produces a far more realistic benchmark than a simple average - just as no one would compare Apple’s stock price with a brand-new IPO to judge if the market is moving up or down.

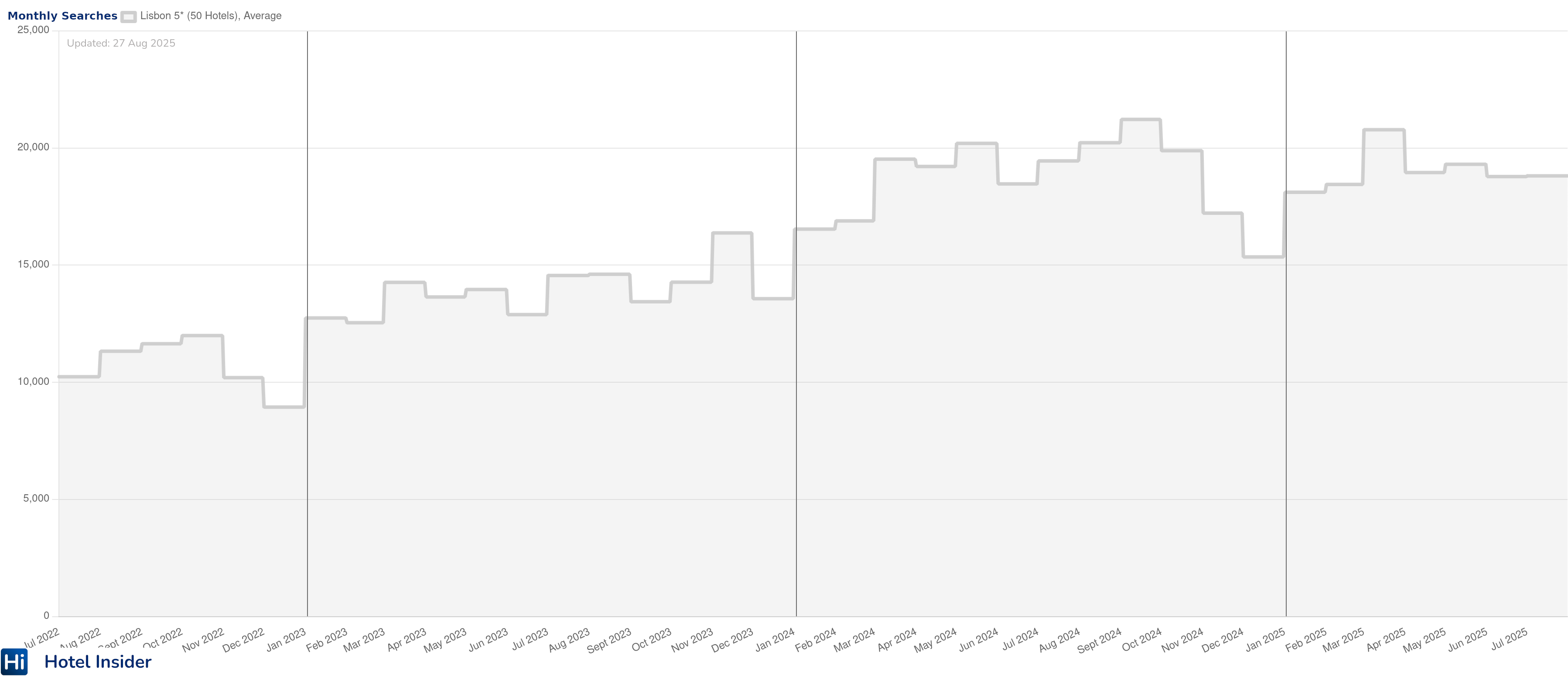

Monthly Searches

This chart shows the average number of monthly searches per 5-star hotel in Lisbon over the past three years.

What’s Happening?

-

Seasonality: Minimal

Unlike leisure-heavy resort destinations, Lisbon shows only light seasonality. Searches dip slightly in December and January, then recover by February and remain stable through the rest of the year. There are no sharp summer spikes, confirming Lisbon’s steady year-round demand base. -

2023–2025: Growth Trend

Average monthly searches rose from roughly 10,000–12,000 in 2022 to consistently 18,000–21,000 by mid-2025. This indicates robust market growth and rising global attention on Lisbon as a luxury city-break and conference destination. -

Short-Term Fluctuations

Occasional step-changes are visible—likely linked to major event announcements or shifts in airline capacity—but the baseline trend remains upward.

💡 How to Use This:

Hotel Insider lets you compare your hotel's search volume against the market average. This shows if your property is overperforming or underperforming competitors and, more importantly, whether it is gaining or losing popularity relative to the market. Tracking this against the market is key - absolute search numbers alone do not show true performance.

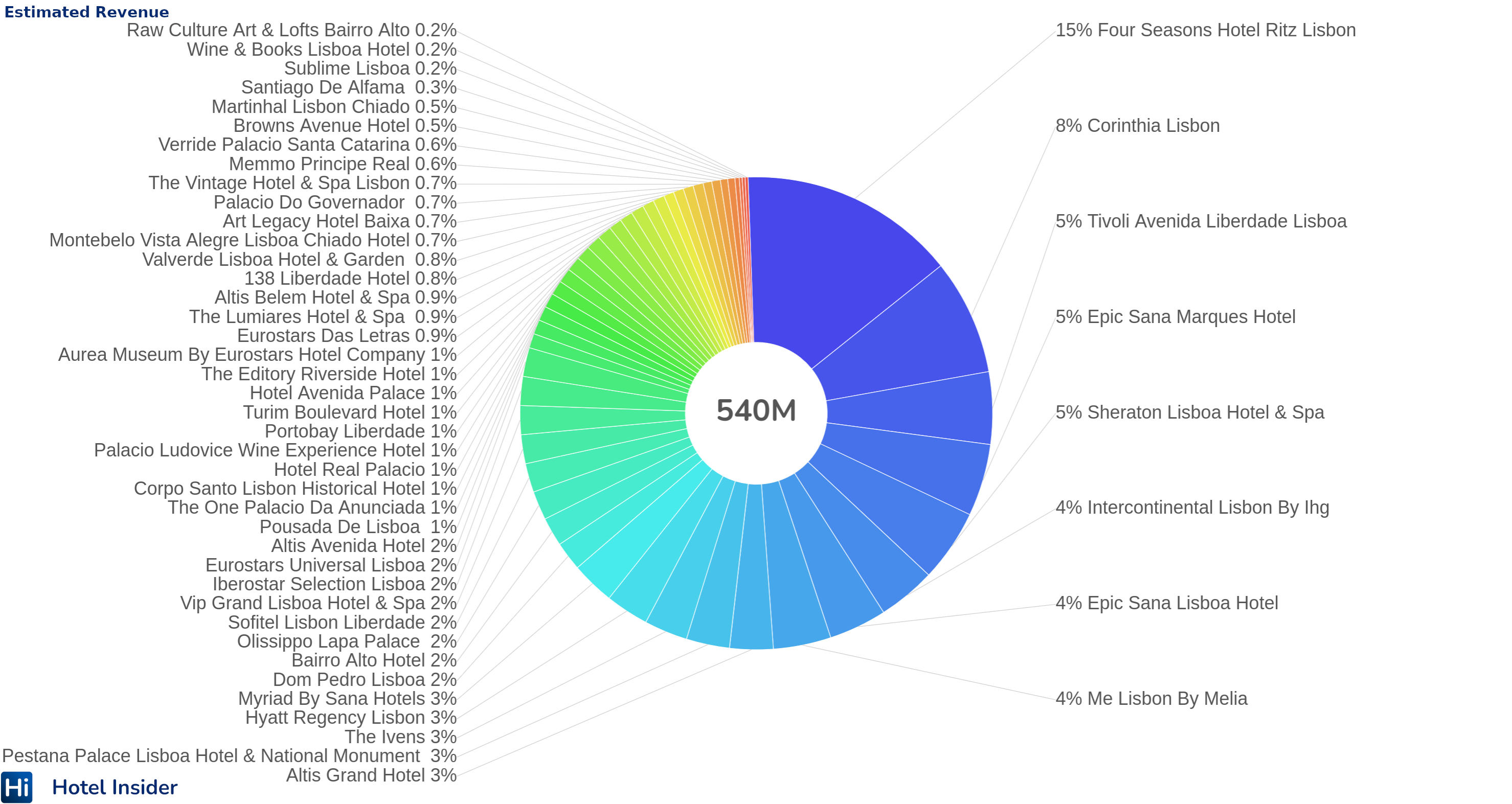

Estimated Revenue Distribution

The chart below breaks down revenue distribution across Lisbon’s 5-star hotel market, showing which properties generate the most income and how the market is shared among top players.

Key Insights:

- Market Leader – Four Seasons Hotel Ritz Lisbon remains dominant with 15% of the market’s total revenue, maintaining a clear lead over all competitors.

- Strong Upper Tier – Corinthia Lisbon follows at 8%, while Tivoli Avenida Liberdade Lisboa, Epic Sana Marques Hotel, and Sheraton Lisboa Hotel & Spa each contribute 5%. Together, these five hotels control 38% of the total market.

- Healthy Mid-Tier – Intercontinental Lisbon, Epic Sana Lisboa Hotel, and Me Lisbon By Melia each generate 4%, with more than 20 other hotels contributing between 1–3% each, representing a diverse mid-market segment.

- Long Tail of Smaller Players – Over 15 hotels generate 1% or less of revenue each, including boutique options such as The Vintage Hotel & Spa, Valverde Lisboa Hotel & Garden, and Palacio Ludovice Wine Experience Hotel. These properties rely on high-touch service and targeted clientele to stay competitive.

Lisbon’s 5-star market continues to show a strong leader alongside a robust mix of mid-tier and boutique players, ensuring healthy competition and diverse offerings for luxury travelers.

Market Size

Based on hotel rates, availability, occupancy, and room count, the estimated total value of the 5-star hotel market in Lisbon is approximately €540 million. This highlights the significant contribution of Lisbon to Portugal’s overall luxury hospitality sector.

This Market Monitor analysis is powered by key data insights from PanAdvert—a leading digital marketing and performance agency specializing in luxury hospitality.