▶Market Monitors

▶Reviews

▶Case Studies

Rhodes 5-Star Hotel Market Revealed

by Hotel Insider • 24 Apr 2025 • Download as PDF

Location: Greece, Rhodes

|

Rhodes’s 5-star hotel scene continues to flourish, fueled by its rich history, vibrant coastal charm, and appeal to high-end international tourists. From ancient ruins to luxurious beach resorts, Rhodes combines cultural heritage with top-tier hospitality, making it a premier destination in the Dodecanese. In this Market Monitor, we dive into the essential factors shaping Rhodes's luxury hotel market, with a focus on six key areas:

|

By analyzing these key aspects, we uncover how Rhodes is evolving as a high-end travel hub—highlighting when hotels thrive, how they outperform, and where the most value is created in this competitive luxury segment.

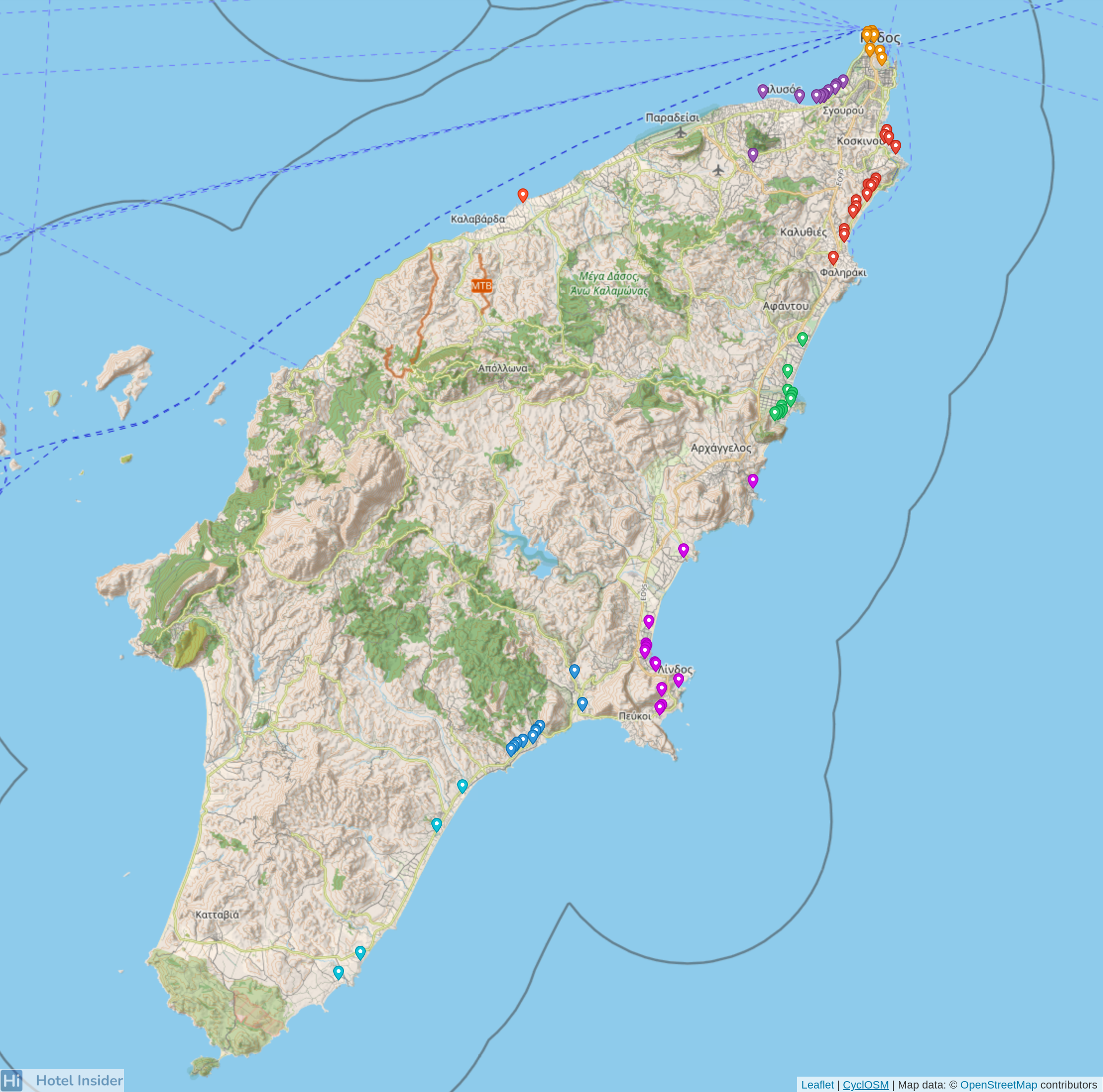

Where Are the 5-Star Hotels in Rhodes?

This map shows how 5-star hotels are distributed across Rhodes—a large and diverse island with a mix of ancient heritage, beachside resorts, and natural escapes. Each area has its own vibe and appeal, attracting different types of high-end travelers.

● Rhodes Town – A blend of medieval charm and modern luxury. Here, 5-star hotels cater to guests who want cultural experiences, historical exploration, and upscale stays within walking distance of restaurants, museums, and the port.

● Kolymbia / Afandou – A quieter, family-friendly area known for long beaches and golf courses. Luxury resorts here offer space, sea views, and an easygoing atmosphere, perfect for relaxing away from the crowds.

● Ixia / Ialyssos – These west-coast resort towns are popular with international visitors and windsurfers. Many of the island’s large beachfront hotels are located here, offering sunsets, pools, and premium experiences close to the airport.

● Kiotari / Lardos / Pefki – Known for all-inclusive beachfront resorts and stylish new developments, this southern stretch is ideal for couples and families looking for modern amenities and laid-back coastal living.

● West Coast (outside main towns) – Fewer hotels but growing interest. This part of the island offers privacy and views, with some boutique luxury options that focus on nature and wellness.

● Faliraki / Kallithea – A lively area with large resorts, water parks, and nightlife. These spots attract younger travelers and families looking for a fun, energetic atmosphere with full-service 5-star hotels.

● Lindos Area – One of Rhodes’s most iconic areas, with whitewashed villages, acropolis views, and stunning beaches. Luxury hotels here are often boutique-style, offering elegance, tradition, and incredible scenery.

● Plimmiri / Gennadi – Located further south, this peaceful coastal stretch hosts some of the island’s most exclusive resorts. Ideal for travelers seeking seclusion, spa retreats, and upscale escapes.

From historic towns to beachfront hideaways, Rhodes offers a rich mix of luxury experiences—whether you're into culture, comfort, or coastal calm.

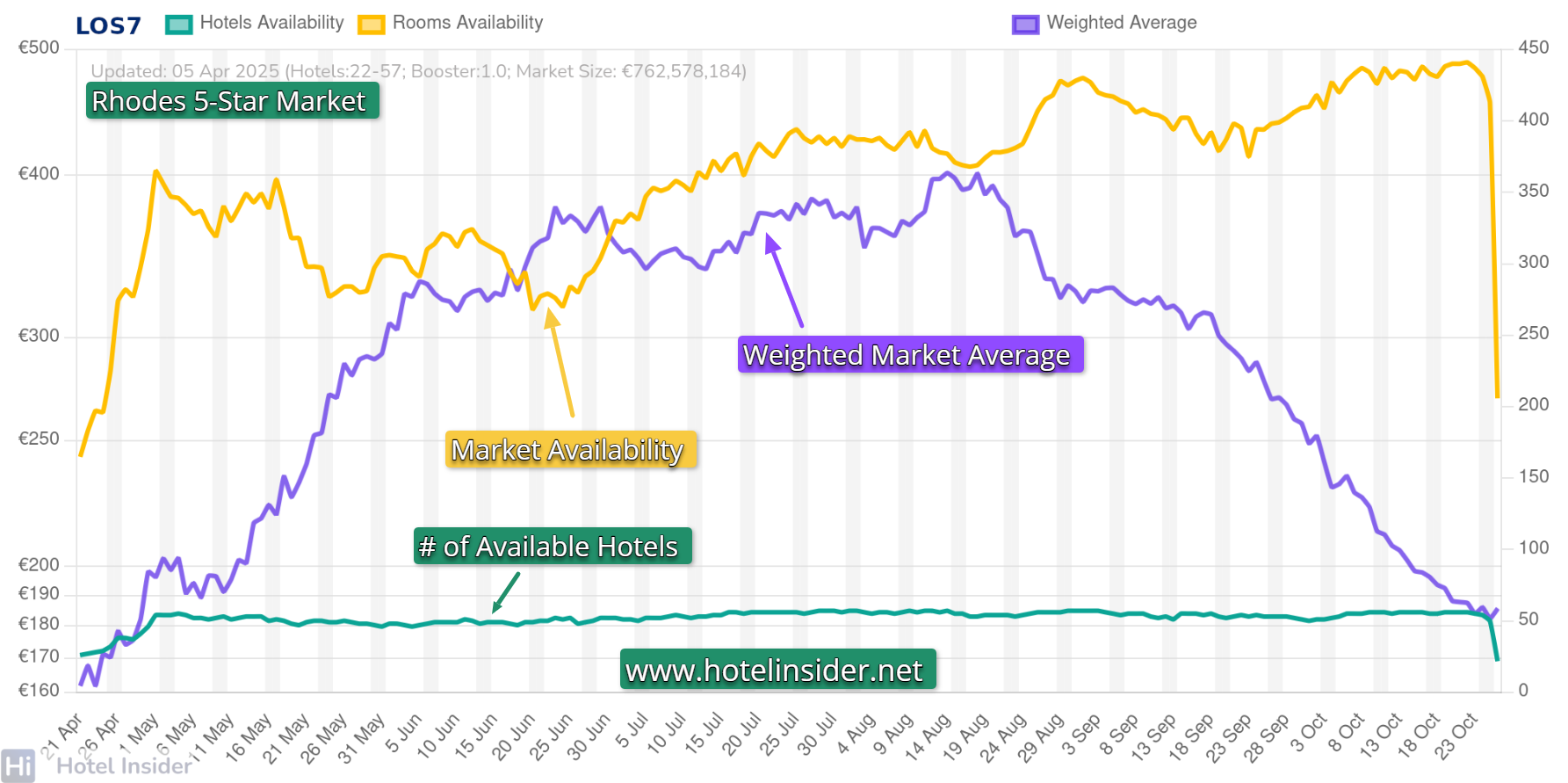

Rates For Season 2025

Here’s a look at how the 2025 season is shaping up for 5-star hotels in Rhodes. This chart shows trends based on a 7-night stay, which remains the most typical booking pattern for luxury holidaymakers on the island. Rhodes, with its resort-style appeal and all-inclusive offerings, attracts longer-stay leisure travelers rather than short-stay city visitors.

Hotels begin opening gradually in mid-to-late April, with low pricing and wide availability. As early May arrives, both rates and demand start climbing—coinciding with early summer travelers locking in their bookings.

From June through August, the market heats up significantly. Rates peak in early July and again in early August, with the average LOS7 price exceeding €400. This aligns with maximum occupancy and reduced availability, especially for larger and more prominent resorts.

September continues to show solid performance, particularly in the first half, with rates remaining strong and availability still limited. However, from late September onward, the market shows a clear cooldown. Prices and booking volume begin their seasonal decline.

By mid-to-late October, hotel availability drops sharply as many properties begin closing operations for the winter.

💡 How to use it:

Rates in Rhodes fluctuate considerably during peak and shoulder seasons. For hoteliers, dynamic pricing and real-time strategy adjustments are critical. Instead of relying on fixed high/low season pricing or last year's calendar, teams should adopt active revenue management practices to maximize yield and avoid underpricing during compression periods.

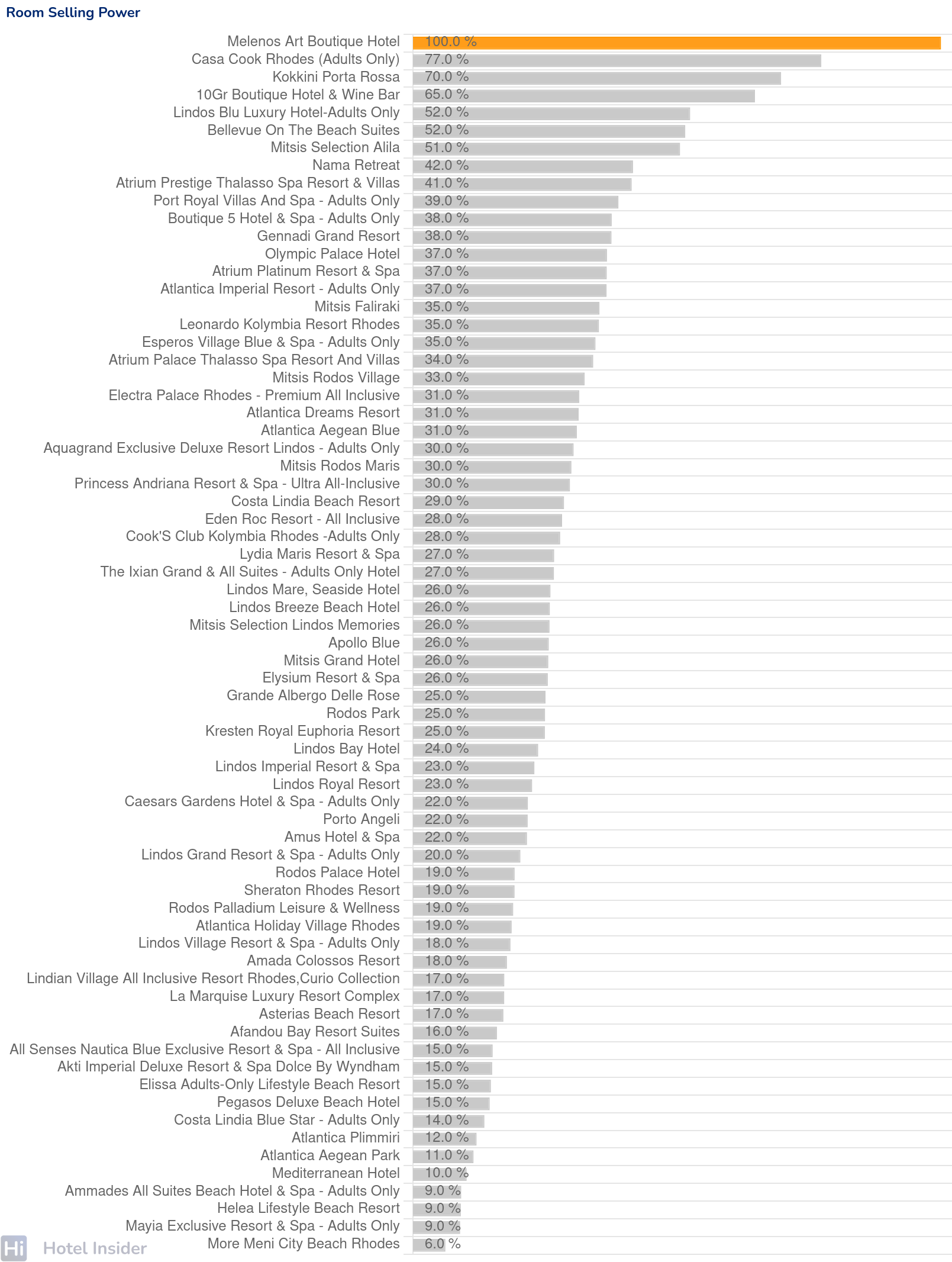

Room Selling Power

Not all 5-star hotels in Rhodes perform the same when it comes to getting bookings. The chart below shows which properties are doing best at actually filling rooms. This “Room Selling Power” rating reflects how well a hotel converts visibility into real demand—based on popularity, brand strength, reputation, reviews, value for money, and how many rooms it has to sell.

🏆 Here are the Top 15 hotels in Rhodes with the highest room-selling power:

- Melenos Art Boutique Hotel (100.0%) – A unique boutique property that leads the list with charm, exclusivity, and flawless guest experiences.

- Casa Cook Rhodes (Adults Only) (77.0%) – Trendy, design-led, and adults-only, this resort is highly sought after by modern travelers.

- Kokkini Porta Rossa (70.0%) – A historic boutique gem with limited rooms and outstanding personalized service.

- 10GR Boutique Hotel & Wine Bar (65.0%) – Intimate and stylish with a strong wine and culinary identity, it attracts niche clientele.

- Lindos Blu Luxury Hotel - Adults Only (52.0%) – A consistent top performer for adults seeking refined luxury and views.

- Bellevue On The Beach Suites (52.0%) – An upscale beachfront escape known for its exclusivity and personalized service.

- Mitsis Selection Alila (51.0%) – A flagship all-inclusive known for quality, design, and strong brand reputation.

- Nama Retreat (42.0%) – A rising boutique destination with a tranquil atmosphere and modern aesthetic.

- Atrium Prestige Thalasso Spa Resort & Villas (41.0%) – A luxurious escape with spa offerings and top-tier hospitality.

- Port Royal Villas And Spa - Adults Only (39.0%) – Elegant, serene, and adult-focused, with strong return guest loyalty.

- Boutique 5 Hotel & Spa - Adults Only (38.0%) – Sleek and stylish with an intimate atmosphere and high ratings.

- Gennadi Grand Resort (38.0%) – Sustainable and upscale, this resort combines design with eco-conscious operations.

- Olympic Palace Hotel (37.0%) – A well-rounded choice offering modern rooms, family appeal, and strong booking momentum.

- Atrium Platinum Resort & Spa (37.0%) – Known for service and sea views, this hotel blends business and leisure appeal.

- Atlantica Imperial Resort - Adults Only (37.0%) – Part of a trusted brand, offering a relaxing stay with top amenities and loyal guests.

These hotels lead the pack when it comes to converting interest into bookings—and they’re often the first to sell out during peak months. If you're a traveler, book them early. And if you're a competitor, these are the benchmarks to beat.

💡 How to use it:

Knowing where your hotel stands in this ranking—and watching how it moves over time—can explain a lot. If you're selling out too quickly, maybe your pricing is too low. If you're spending on ads but bookings stay slow, your room-selling power might need work. Tracking this helps you understand when to adjust your strategy, improve your visibility, or rethink your value proposition.

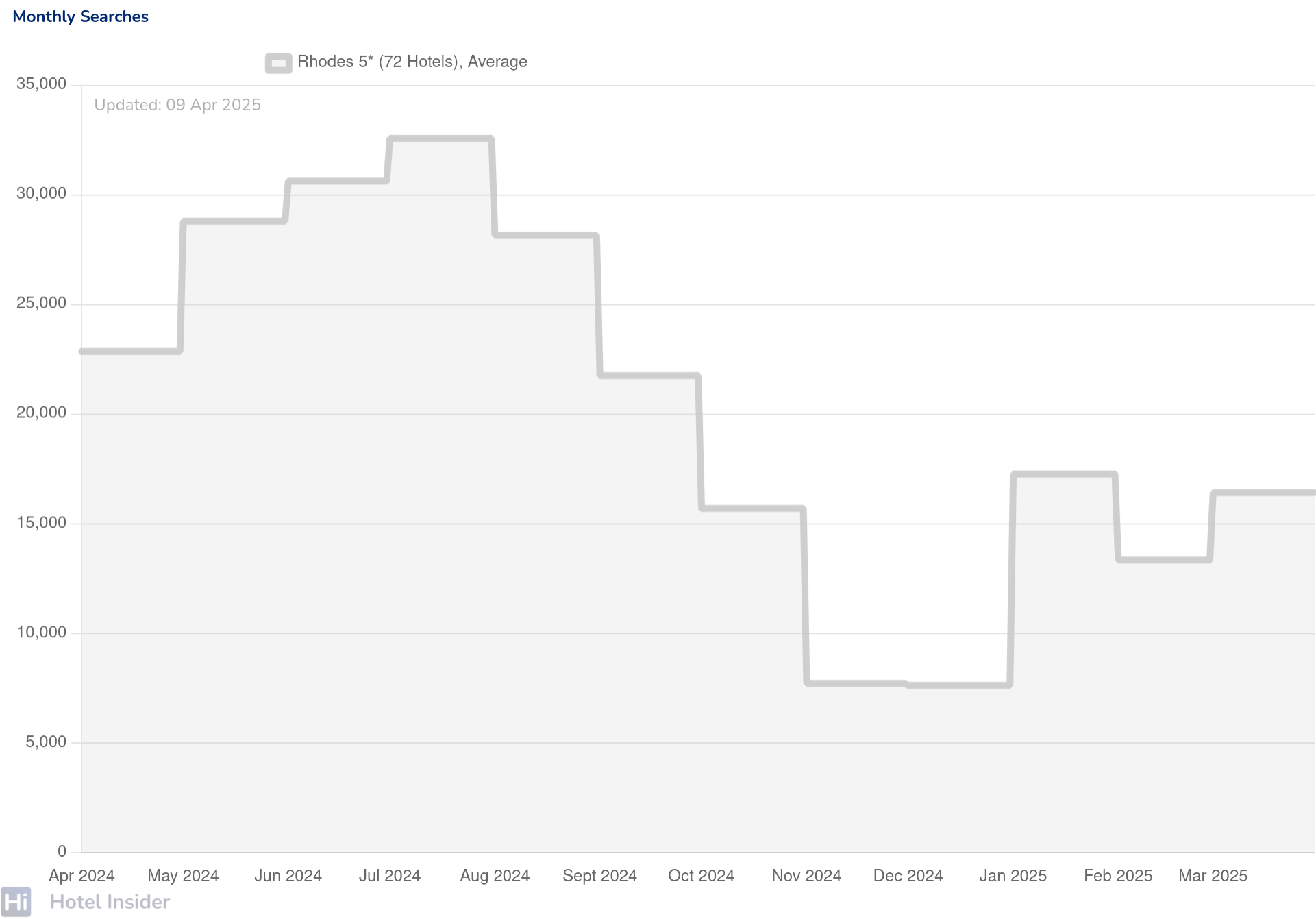

Monthly Searches

This chart shows how many people were searching for 5-star hotels in Rhodes each month over the past year. It’s a useful tool to understand when travelers are planning trips—and when hotels should focus their marketing and sales efforts.

🧐 What’s Happening?

-

April–August 2024: Peak Season Planning

Searches begin at around 23,000 in April, then climb rapidly—reaching over 30,000 by June and peaking at nearly 33,000 in July. This reflects early summer planning behavior and peak interest during the high season. -

September–October 2024: Post-Summer Cooldown

Interest declines gradually through September (still strong at ~28,000), before dipping sharply to around 22,000 in October. -

November–December: Off-Season Lull

Search activity falls further, reaching its lowest point in December—under 15,000 searches, consistent with winter off-season trends. -

January–March 2025: Demand Starts to Rebuild

January sees a rebound to ~17,000, with some fluctuation in February, and a slight rise again in March—hinting at early interest for the upcoming summer.

💡 How to Use This:

For hotel teams, it’s useful to compare your own property's online search trends with the market average. If your visibility is growing faster than the average, you're on the right track. If it’s not, it might be a sign that you need to improve your marketing or online presence.

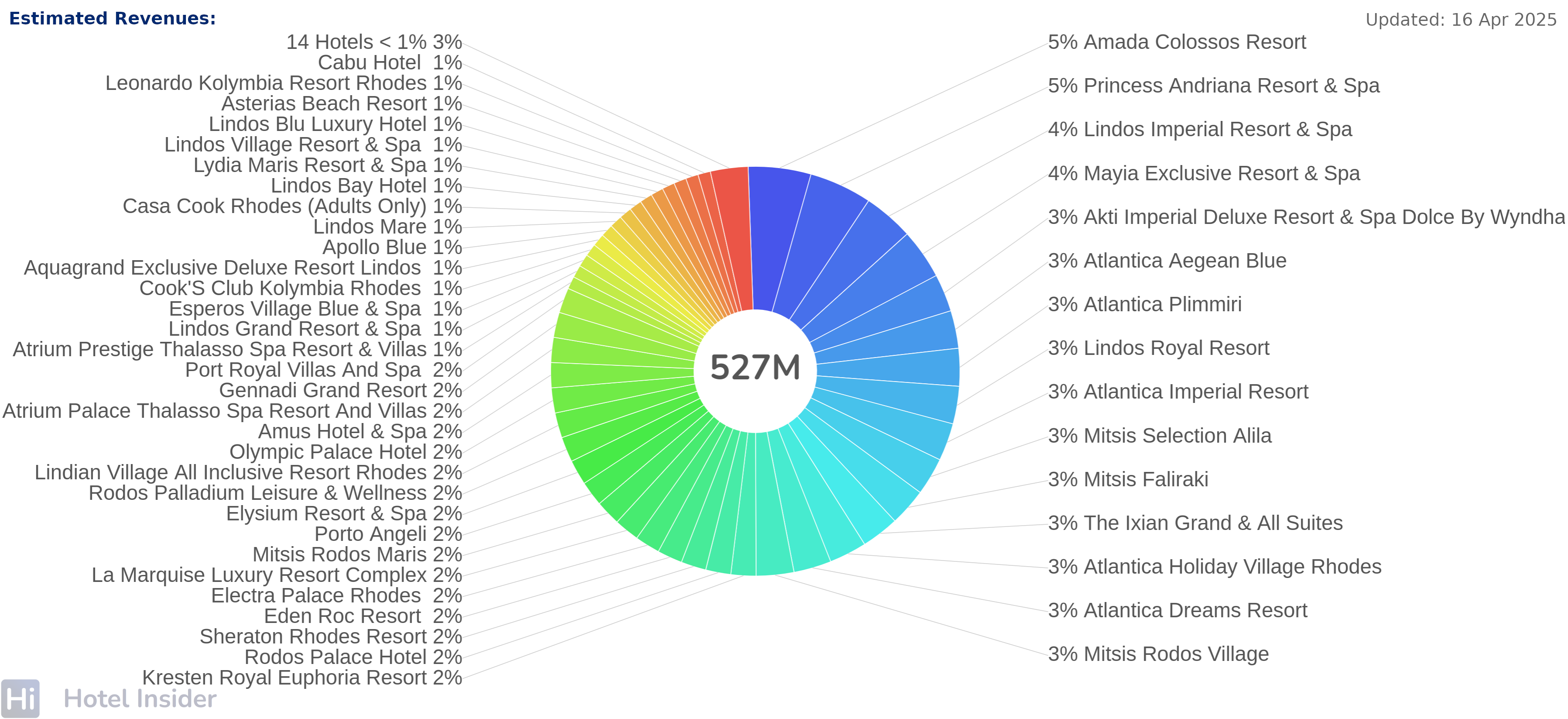

Estimated Revenue Distribution

The chart below breaks down revenue distribution across Rhodes’ 5-star hotel market, showing which hotels generate the most income and how the market is shared among top properties.

Key Insights:

- Market Leaders – Amada Colossos Resort and Princess Andriana Resort & Spa each generate 5% of the market’s total revenue. Close behind are Lindos Imperial Resort & Spa and Mayia Exclusive Resort & Spa, both with 4%. These top four hotels account for nearly 18% of the market, reflecting strong demand and scale.

- Balanced Mid-Tier – A large cluster of hotels contribute between 2–3% of revenue each. This includes names like Akti Imperial Deluxe, The Ixian Grand & All Suites, Mitsis Faliraki, Atlantica Dreams Resort, and Eden Roc Resort. This tier is vital for maintaining the island’s broad appeal and distribution.

- Long Tail of Smaller Players – Over 30 hotels individually contribute just 1% or less to total revenue. This group includes boutique properties, smaller resorts, and niche offerings that rely heavily on personalized service, direct bookings, and loyal repeat guests.

Rhodes’ 5-star segment reflects a healthy mix of large-scale resorts and a wide base of smaller players.

Market Size

Based on hotel rates, availability, occupancy and room count, the estimated total value of the 5-star hotel market in Rhodes is approximately €527 million. This underscores its status as one of the most important luxury tourism hubs in the Greek islands.

This Market Monitor analysis is powered by key data insights from PanAdvert—a leading digital marketing and performance agency specializing in luxury hospitality.